Target’s Cautious, Challenging Earnings: Digital Decline and Heavy Discounting Crushes Operating Income

Target is one of the leading retail companies in the United States, with a wide range of products available in their physical and online stores. Overall, Target is still a great retailer with great merchandise. Unfortunately, no one seems to want this merchandise in this inflationary economy. In this text, we will examine Target's recent performance, highlighting their Q4 2022 and full-year 2022 results, and discuss some key issues they face.

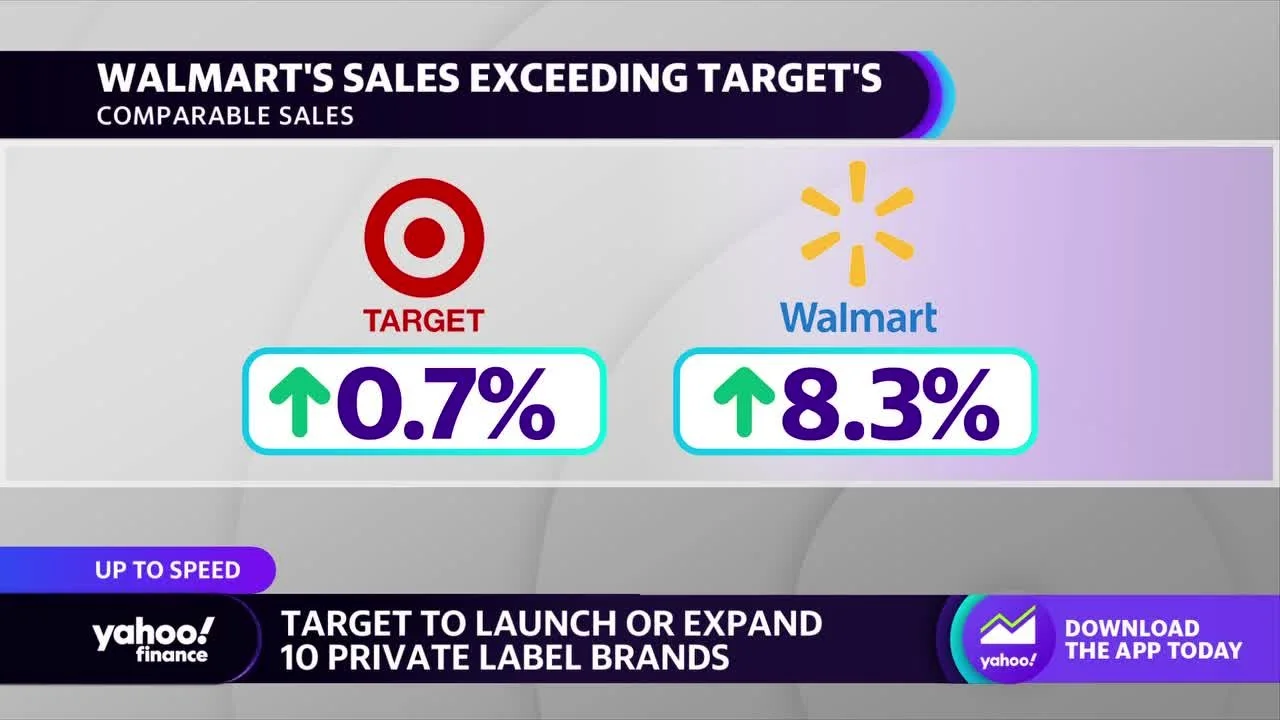

What were Target's Q4 Results Compared to Walmart

Q4 comp store sales grew 0.7 % (under inflation) [Walmart 8.3%]

Target’s digital strategy needs to catch up to their main eCommerce competitors on a few fronts: marketplace and ads. Their results showed a digital sales decline in Q4 of 3.6%. [Walmart up 17%]

Target’s lack of ads progress is notable, with “Other” revenue going up only 9.8% on the year -- probably this includes Shipt too (hard to tell)? [Compare this to Walmart’s 41% US Connect and Amazon’s 23% y/y growth on much higher bases.]

Marketplace is missing in action. Difficult to make a material difference in a scaled retailer with a curated marketplace strategy. At their size, they need to go big or go home. While a few merchants have enjoyed outsized success on Target, the initiative has been underwhelming.

What were the Highlights of Target's Q4 2022 and Full Year 2022 Results?

Q4 2022 Highlights:

Comparable sales increased 0.7 % driven by an increase in guest traffic.

Operating income was $1.2 billion in fourth quarter 2022, down 44.7 % from $2.1 billion in 2021.

Total comparable sales grew 0.7 % reflecting comp stores sales growth of 1.9 % and a comparable digital decline of (3.6) percent.

Total revenue of $31.4 B grew 1.3 %: sales growth 1.2% and 8.4% increase in "other" revenue (ads).

Gross margin 22.7 %, compared with 25.7 percent in 2021 caused by an array of challenges: clearance, markdown, shrink.

Inventory at the end of the quarter was 3 percent lower than in 2021, despite an increase in early receipts compared with last year. (13% lower in discretionary, higher in frequency categories)

Full-Year 2022 Highlights

Total revenue of $109.1 billion grew 2.9 %: sales growth 2.8% and 9.8% increase in "other" revenue. (ads, I think)

Sales increased 2.8 percent y/y, with 2.2 % increase in comparable sales.

Operating income of $3.8B in 2022 down 57% percent from $8.9B last year.

Gross margin rate was 23.6 %, compared with 28.3 percent in 2021.

How Cautious is Target Being in the Current Operating Environment?

In a word? Very. Here are a few select quotes from the retailer:

“Very challenging environment”

“Strength in Food & Beverage, Beauty and Household Essentials offset ongoing softness in discretionary categories. This performance highlights the benefit of our multi-category merchandise assortment, “

“We are planning our business cautiously in the near term to ensure we remain agile and responsive to the current operating environment. We're pleased that we entered the year in a very healthy inventory position, reflecting our conservative approach in discretionary categories and our commitment to reliability in our frequency businesses. “

Perhaps if Target and Walmart are both being cautious about 2023, you should be as well?

Wrapping Up

Target's recent results show a mixed picture, with some areas of strength and other areas of weakness. While Walmart beat them out in Q4 comp store sales growth, Target's multi-category merchandise assortment helped to offset at least some the ongoing softness in discretionary categories. Target's digital strategy initiatives still need to catch up to their main competitors, and their lack of progress in ads and marketplace is notable. Target is operating in a very challenging environment, and they will need to remain agile and responsive to overcome the challenges they face. All this despite their healthy inventory positions and cautious approach to planning their business strategies.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on Target, you might also like: